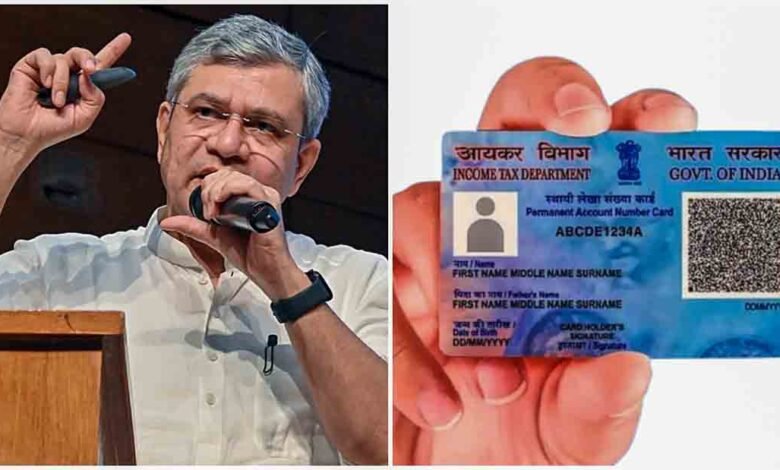

PAN 2.0: Modernizing the Permanent Account Number System

The Central Government has taken a significant step towards modernizing India’s tax infrastructure by approving the Permanent Account Number (PAN) 2.0 project. This ₹1,435-crore initiative, sanctioned by the Economic Affairs Committee of the Union Cabinet under Prime Minister Narendra Modi’s leadership, aligns with the government’s ambitious Digital India campaign.

The project is aimed at enhancing the efficiency and security of PAN and Tax Deduction and Collection Account Number (TAN) management systems. The upgraded system will include new features designed to make tax-related processes smoother and more reliable for Indian citizens.

What is PAN 2.0?

PAN 2.0 is an advanced version of the existing PAN card. The key highlight of the new card is the inclusion of a QR code that can be scanned to instantly retrieve taxpayers’ information. However, citizens need not worry about applying for a new card as the updated version will be delivered automatically to their registered addresses.

According to Union Minister Ashwini Vaishnav, the existing ten-digit alphanumeric PAN number will remain unchanged. The QR code feature will streamline various tasks like tax payments, company registrations, and opening bank accounts, thereby significantly reducing processing time and complexity.

Why the Upgrade is Necessary

The existing PAN system, running on software developed 15-20 years ago, has faced challenges in meeting the demands of modern tax administration. Issues such as financial fraud, identity theft, and inefficiencies in tax filing have prompted the government to introduce a more robust and secure digital system.

How Will PAN 2.0 Benefit Citizens?

- Enhanced Security:

- The inclusion of a QR code minimizes the chances of fraud and identity theft.

- Financial security will improve as fake PAN cards can no longer be created.

- Ease of Access:

- Citizens do not need to reapply; their updated PAN cards will be sent directly to their homes.

- Tasks like tax filing, account opening, and company registration will be more efficient.

- Faster Processing:

- Modernized software will ensure that complaints, transactions, and other requests are processed swiftly.

How to Get the New PAN Card?

Existing PAN cardholders will not need to take any additional steps. The Income Tax Department will automatically update the system and send the new QR code-enabled cards to taxpayers’ registered addresses.

The Digital India Impact

This initiative reflects the government’s commitment to creating a digitally empowered India. By modernizing tax administration, PAN 2.0 aims to simplify processes for citizens while ensuring the security and integrity of the financial system.

As the rollout progresses, taxpayers can expect a seamless transition to this upgraded system without any disruption to their current activities.